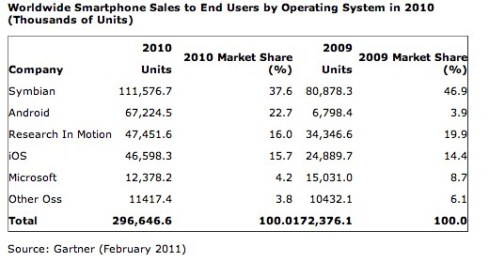

According to Gartner Research, as of February 2011, Android has surpassed iOS in unit sales. Their research also indicates that Nokia’s Symbian maintains market leader status although the combined Android and iOS sales momentum in 2010 should have them worried about that status in 2011.

According to Gartner Research, as of February 2011, Android has surpassed iOS in unit sales. Their research also indicates that Nokia’s Symbian maintains market leader status although the combined Android and iOS sales momentum in 2010 should have them worried about that status in 2011.

This is very important information to a marketer … at an aggregate level it would appear that marketers should continue to embrace iOS but need to ensure that they have a presence or app available for Android as well. The press that the iPhone commands is misleading to marketers! If your app is not available to Android (or Symbian) users then you are not engaging 67 Million folks (or 111 Million). Scary, huh? And don’t get me started on organizations that are optimizing mobile sites for iOS with no thought or regard to Android … (note: I have both an iPhone and an Android based phone).

While the iPhone and iOS are “sexy” and hot topics … it is possible that the closed environment or ecosystem combined with limited distribution of Apple products may once again prove a challenge to Apple’s market dominance. It wasn’t that long ago that Apple PC’s enjoyed a lion’s share of the market but limited distribution, closed environments, and high prices enabled Microsoft to quietly eclipse Apple as a market owner in less than 5 years. This would explain the introduction of the iPhone to Verizon users this month – someone at Apple finally realized that they had limited access to the smartphone market with AT&T while Android based phones are offered by every carrier.

The lesson? Organizations need to ensure that their mobile marketing presence is not limited to the Apple ecosystem. The aggregate data and market research confirms that the iOS market share represents a minority of overall market opportunity. Marketers who are partial to the iOS platform (and Apple) should be worried about the rapid increase in Android unit sales this past year … check it out for yourself in this killer video that shows the slow build of momentum since 2008 of the Android platform based on global Android activations from 2008 – 2011. Pay particular attention to how quickly the platform base growth accelerates in 2010 and early 2011:

Related Articles

- Silicon Alley Insider: 7 Reasons Why You Should Buy An iPhone Instead Of An Android Phone (GOOG, AAPL) (businessinsider.com)

- Consumers now more likely to purchase Android device than iPhone (creativedepartment.com)